Payday is every person’s favorite day unless you are an administrator. You spend half of the month checking the attendance and performance data of the staff, and the complex salary calculations are add-ons. In addition, taxes, benefits, and other components must be taken care of. These all tasks can be tedious and consume much time of managers. Fortunately, automated systems help to eliminate different obstacles to the salary generation process and boost accuracy.

Payroll software will not only save you time, but it will also ensure that you are generating accurate salaries and saving valuable costs for the business. Therefore, managers who are still running the old-school manual process should give modern systems for their ease of work.

There are numerous payroll software providers out there, but choosing the best out of them can be confusing. Therefore, we have created a list of top systems to help you get the most out of the payroll process.

Table of Contents

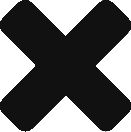

UBS

When it comes to choosing payroll software, UBS is a prominent name to consider. It is efficient and helps you generate accurate salaries to meet the payroll and compliance needs.

It helps you get control of the payroll process and ensures you don’t get late in providing wages. It lets you define salary formula, deduction & earning components, and pay period. Also, the salaries can be scheduled in advance.

It integrates well with its other offerings, and with project management tools also. Therefore, the administrator does not have to perform tedious data management on multiple platforms; they can easily manage it from a single platform.

Key Features:

- A comprehensive salary structure can be made through UBS, and different types of bonuses/incentives and deductions can be defined.

- The manager can also handle the entire process from a single dashboard and track the progress. Even he is able to schedule the salaries in advance, so it doesn’t get missed.

- It allows crafting a custom salary slip in which all the salary and statutory components can be defined.

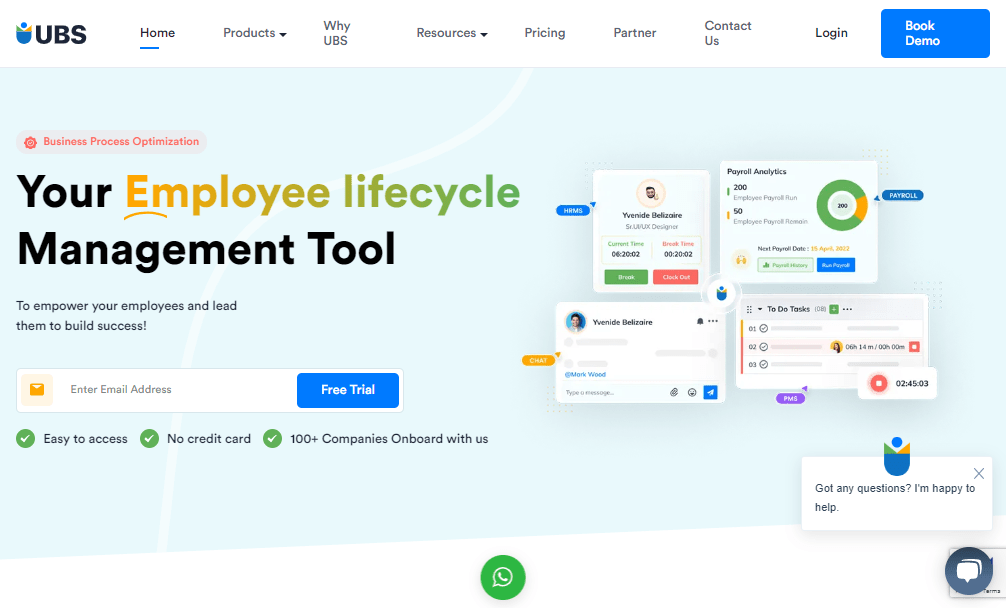

factoHR

factoHR is a cloud-based HR & Payroll software for businesses of all sizes. The system allows managers to easily handle every aspect of the salary generation process and ensures accuracy.

Whether you need to manage employee data, attendance, or performance metrics, the software solutionizes it easily. It then connects attendance and KPI scores with the salary generation process, so your staff gets paid according to the time they provide and work quality.

The system’s integration with prominent software such as SAP, QuickBooks, and Oracle fulfills the accounting needs of the payroll process. Additionally, the PF, ESIC, Professional Tax, and TDS can also be managed.

Key Features:

- Based on the industry and business type, managers can configure the pay structure according to their needs. They define the calculation formula and add unlimited types of earning and deduction components.

- If the business allows employees to take loans, then the system helps to manage it. Loans and advancements are entered, and EMI deductions are defined; further, the deduction will be made automatically from salaries.

- Payslip can be generated in multiple formats, and the distribution can be done in just seconds. In addition, staff members can download the slips right from their devices with valid credentials.

Hourly

Hourly is another efficient software on the list that assists HR professionals in managing the salary generation process. It reduces the time consumed by the process from day to just hours.

The system assists in managing employee time records, generating salaries, and staying law-compliant. In addition, the software allows you to track employees’ time and tasks, and you can choose to track client, project, or location-wise to get specific data.

Software is integrated with workers’ comp insurance, so the billing gets easy and accurate. In addition, managers can browse various insurance plans for their workers from their devices and choose the best ones.

Key Features:

- Managers can manage numerous payroll cycles with Hourly, and they define multiple types of deductions for different employees.

- Salaries can be scheduled to be credited to employees’ bank accounts at the desired time. Or reminders can be set to get things done at the right time.

- All types of taxes are calculated, filled, and paid during the process; therefore, the managers can devote their time to other essential things.

Sumopayroll

Sumopayroll is a web-based payroll system that efficiently manages the salary generation process of businesses.

The software allows tracking and calculating employee work hours and syncs up the data so precise calculations can be made. It also offers tax calculations and filings on behalf of the workers and company.

It can be integrated with famous accounting tools to ensure the accuracy of accounts and books.

Key Features:

- Sumopayroll enables a central database for employees’ information in which their salaries can be defined easily. And their statutory deductions can also be mentioned.

- Disbursed loans and advances are easily managed with the system, and they can be automatically collected through salary deductions.

- Managers can generate monthly, quarterly, or annual reports to take a glance at the salary process.

SaralPayPack

SaralPayPack streamlines the entire pay cycle and ensures valuable time savings for HR managers.

It lets you store employees’ information in a centralized database, configure the salary structure, and record the attendance & leave data. Even there are different tools for statutory requirements to manage returns and reporting.

It allows integrations with Matrix Security Solutions to get enterprise-level mobility management and with Zeta Reimbursement Cards to efficiently manage employee benefits.

Key Features:

- Structure configuration capabilities equip managers with features that help them to define a salary structure. Statutory, loan and other components can also be integrated with the structure.

- Attendance and leave management fetches data from biometric and non-biometric devices and connects it with the salary generation process.

- Moreover, ECR generation, ESIC payments & reports, and TDS/PT deductions are effortlessly organized.

Paybooks

Paybooks is a prominent software for managers that are looking for an effective solution to automate the salary generation process. It gives you control of the entire pay cycle and improves accuracy.

Employees’ personal information and attendance & leave data are easily managed as it provides workforce management solutions. Additionally, compliance-related needs are also fulfilled.

It allows integrations with ICICI bank for quick bank transfers, NetSuite for accounting entries, and Oracle Fusion for cloud data syncing. Therefore, the managers do not have to worry about any process or work; they get every solution in a single platform.

Key Features:

- It automatically syncs with the biometric devices to track attendance and leave data in real-time.

- Once the calculations are done, managers can preview them before generating, and after they press confirm, payslips get generated automatically. Also, bank statements can be prepared easily.

- The system takes care of the payroll laws and taxes; it calculates PF, ESIC, and professional tax deductions. Employees can declare their investments, and managers can fill out various forms directly through their desktops.

Wave Payroll

Wave is one of the most popular payroll systems out there. It is the perfect software for SMEs looking to automate their salary process.

It is ideal for businesses seeking payroll, tax management, timesheet, and accounting, all in a single platform. Companies hiring seasonal employees often use the software as it offers easy onboarding and offboarding functionalities.

The system allows integration with its accounting suite, so the journal entries and records get updated with every pay. And integration with Sage People helps to fetch and manage the employee information easily.

Key Features:

- Wave offers timesheets for hourly and salaried employees. The data syncs up with the system database, and accurate salaries are generated based on the employees’ work hours.

- It easily connects with your bank account and allows the direct deposit to the employee’s accounts.

- The software allows automated tax calculations and payments, thus saving much time.

Quikchex

Quikchex automates the salary generation process of businesses and equips them with valuable benefits such as time-saving and cost-effectiveness.

It lets you handle payroll and statutory compliance in a secure platform. Arrears, reimbursements, PF contributions, loans, and advances can all be managed easily in the system.

It offers automatic integration with its other modules, such as attendance and performance management, to calculate the salary amount based on the employees’ work hours and achievements.

Key Features:

- The easy-to-use system helps managers set up a seven-step process where they can define the salary structure and calculation formula. They can determine the salary components and schedules.

- Loans & advances are managed easily with Quichex, and EMI gets calculated automatically.

- Once the payroll is done, salary slips get generated automatically, and employees can download them from the ESS portal. Staff can also add their investment declarations and proof submissions right from their devices.

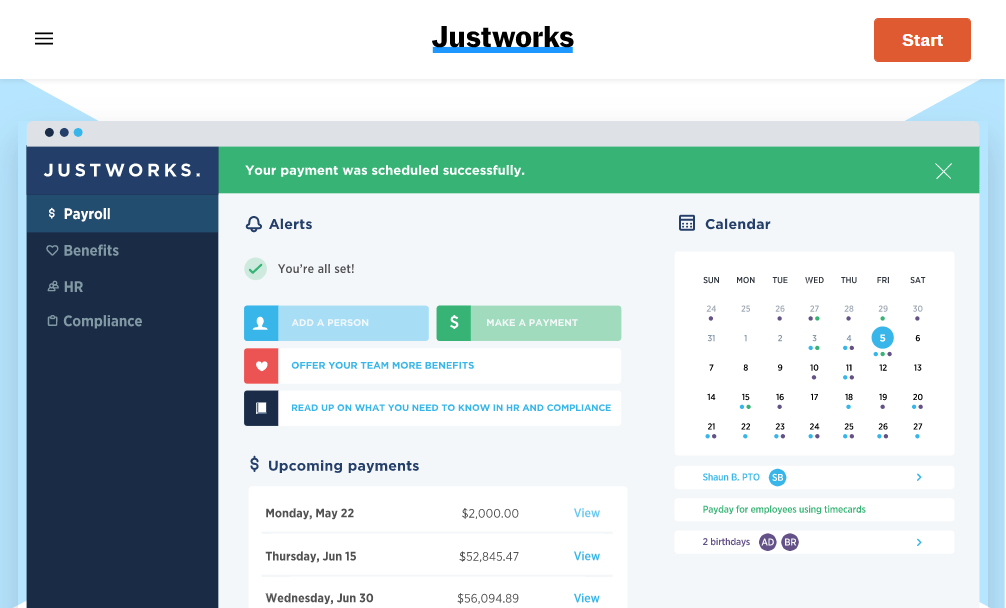

Justworks

Justworks assists HR professionals in handling their entire pay cycle, thus saving considerable time. It allows managing the workflow from anywhere with an internet connection.

The system ensures that managers do not face any complications in the core HR, employee benefits, and statutory compliance practices. In addition, its built-in timesheets feature keeps track of employees’ work and increases the pay process’s accuracy.

Famous accounting systems Xero and QuickBooks can be integrated easily with Justworks, so you do not have to go for accounting entries after the salary process is done.

Key Features:

- It automatically calculates the payroll taxes and assists in form filings. The statutory resources get updated automatically if any changes happen in the regulations.

- PTOs, sick leaves, and vacations of the month are easily calculated and synced up in the process.

- The software manages multiple bank accounts of full-time/part-time and hourly employees. Once the salaries are credited, it automatically sends email notifications to employees along with their pay information.

Sag Infotech

Last but not least, Sag Infotech is one of the best payroll software providers. Its Gen payroll software comes with powerful features that ease the work of HR.

It efficiently manages employees’ data along with their attendance and leaves records. It does not just calculate and generates salaries but also handles the compliance part on behalf of the business.

It seamlessly integrates the employees’ attendance and leaves records with the salary process, thus ensuring that every pay is generated accurately.

Key Features:

- The software calculates the PF, ESIC, and other statutory deductions as per the latest norms and enables the e-filing options.

- Arrears and reimbursements are managed effortlessly, and TDS can also be deducted from the salaries.

- The dashboard gives a quick overview of all the ongoing tasks, and managers can make changes in the salary process from there.

Summary

Using their own software for managerial functions or outsourcing can be costly for a business; therefore, organizations tend to use workforce management systems to manage their employees’ data and save time. A payroll software solutionizes an HR manager’s concerns: managing the employee records and generating the salaries.

It provides enough convenience to an employer in calculating salaries and automating various administrative tasks. It also offers other valuable features such as tax calculations, salary slip generation, and employee benefits. The above-listed systems can help managers in numerous aspects; therefore, companies should try some of these before opting for software.

I am a passionate, adventurous, and insatiate learner who loves to write about the latest technology trends. My experience working in an MNC has motivated me to understand that there are certain niche requirements for writing strategically about brands’ messages towards people’s interests which I’ve mastered over time through trial and error of many projects under various clients across diverse industries. It is my honest effort to put my experiences and knowledge of industry towards readers.